Step 1

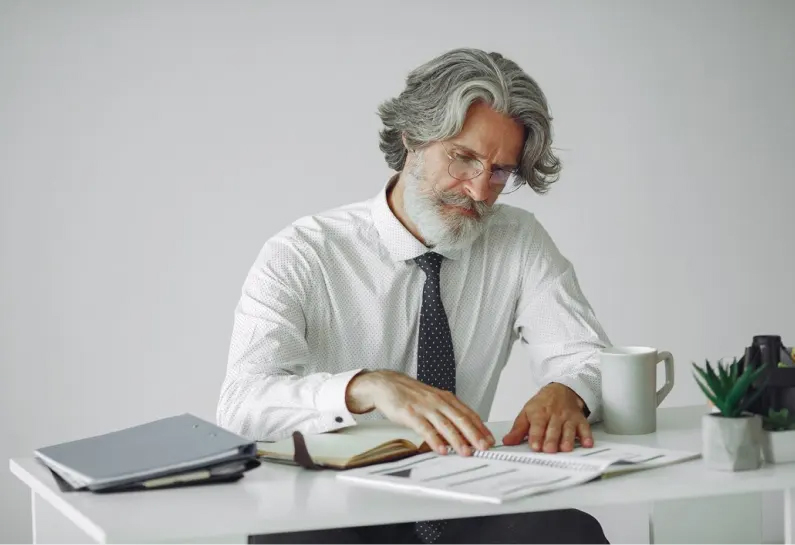

Consultation Call with Our Lawyer

Begin with a detailed consultation to understand your goals and discuss the legal framework for creating a trust. Our lawyers provide personalized advice to align the trust structure with your objectives.

Step 2

Decide Trustees and Rules of the Trust

Identify suitable trustees and outline the operational rules of the trust, including the terms of asset distribution and management. Our team helps you select trustworthy individuals or institutions to oversee the trust’s operations.

Step 3

Register the Trust Deed and Obtain Necessary Documents

We draft and register your trust deed with the appropriate authorities, ensuring all legal formalities are completed. We also assist in obtaining essential documents such as the trust’s PAN card and bank account.

Step 4

Transfer Assets to the Trust

Transfer the designated assets to the trust, ensuring they are legally owned by the trust and not the settlor. Our experts guide you through the asset transfer process, ensuring accuracy and compliance.